Challenges

In the fascinating world of insurance, specifically travel insurance, HighPots has reached a milestone. Our artificial intelligence in the insurance industry is called RiskProphetAI. She changed the method of tariff calculation and exceeded the expectations of insurance companies. In the past, travel insurance rates depended on rigid statistical calculations, where actuaries relied on historical data to make risk assessments. These conventional approaches resulted in standard rates that often could not keep up with the dynamic reality of the travel market. We started the project in 2018 with Signal Iduna in the area of travel insurance (trip cancellation and travel health insurance). The following challenges had to be overcome when establishing AI in the insurance industry:

The following challenges had to be overcome:

Procurement of travel data

Validation of the data

Structuring and Parsing of Data

Relevance of the different travel dates

Testing whether the AI System is Better than that of the Insurance Actuaries

Automation of Feedback and Evaluation of Cancellations and Claims

AI in the Insurance Industry - Approach

The HighPots ML components already changed pricing for a German insurance group in 2018. Meanwhile, the system has become smarter and more comprehensive.

In real time, artificial intelligence in the insurance industry analyzes significantly more parameters than just the classics, such as travel duration, age of travelers, travel price, vacation country, or the place of residence of the travelers. Each individual traveler now receives a tailored insurance rate that precisely reflects their individual risks and needs. In the end, this not only ensures fair treatment of travelers but also financial advantages for insurance companies.

However, the HighPots RiskProphetAI goes far beyond mere tariff calculation – it continuously improves itself. By continuously learning not only from claims that have occurred but also from scenarios that have not occurred, the AI constantly improves its prediction capabilities in real time. The result is a precise risk classification in real time that offers insurance companies an unprecedented level of risk calculation.

Results

And this is just the beginning. In the next version of the AI product, not only will the individual insurance rates be perfected, but also the design of individual contract terms that match the individual insurance rates. The AI insurance rating will thus become not only more personalized but also more transparent and flexible. Furthermore, we will extend the AI to a related insurance area, health insurance. The difference between travel health insurance and health insurance is smaller than it might seem at first glance.

The AI was trained in the insurance industry using data provided to us by GDS providers such as Amadeus, as well as data from insurance companies. The HighPots AI is currently being tested at a Japanese insurance company.

The first results are promising. The contact person for this product is our Head of Research and Development, Rüdiger Off (ruediger.off@highpots.com).

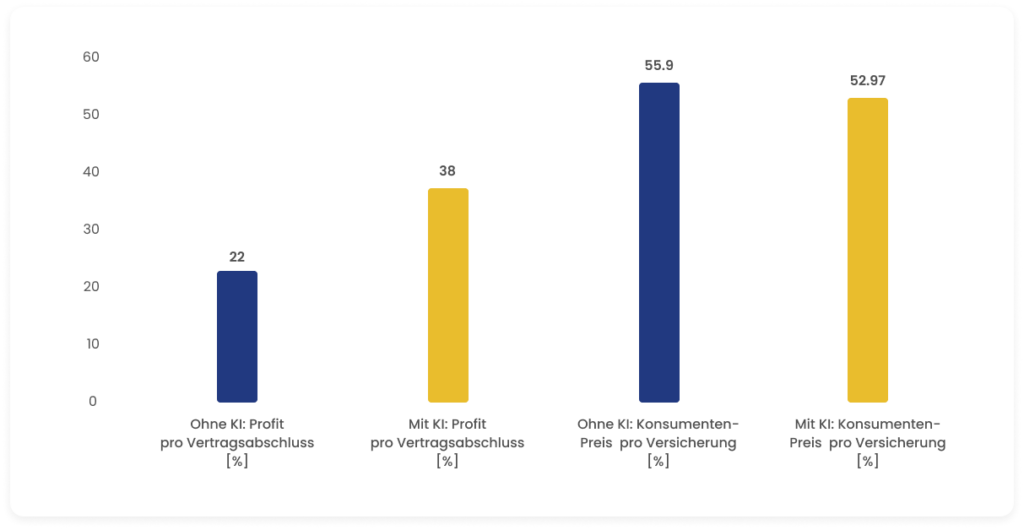

Travel Insurance - Profits for Insurance Companies and Consumers before and after AI Implementation

Analyzed Number

100 000

Type of Travel

Package tour

Age of Travelers

between 40 and 60 years

Type of Insurance

Travel insurance per holiday

Number of Insurance Companies

5 different insurance companies

AI Environments

TensorFlow with continuous real-time learning (HighPots AI Open Source Cloud)

Surprising for Insurance Groups

Age is a crucial parameter, but that doesn’t mean the oldest people are the biggest cost drivers.

Insurance rates

Comparable insurance benefits in travel health and trip cancellation insurance across all 5 insurance companies

Conclusion

We now have proof that actuarial science behaves similarly to meteorology: statistical statements from well-trained expert systems (AI) lead to better risk assessment and thus to more financial gain for insurance companies than conventional actuarial science. It is important that the AI can continuously participate and learn from real-time sales and claim events, essentially the real insurance business. From the perspective of legislation, generating manual intervention options is meaningful, even if they may never be used. For this purpose, the establishment of automated thresholds that enable alarms and associated manual interventions must be implemented. Artificial intelligence in the insurance industry offers revenue increases for insurance companies as well as savings potential for policyholders. Let us design and scale AI together in your insurance company.